This chapter contains the following topics:

Entering Invoices to be Voided

This selection allows you to automatically void an invoice after it has been printed and posted using Invoices.

You might have to void a posted invoice issued to a client if the invoice is in dispute, if the invoice was accidentally sent to the wrong client, if the invoice was issued prematurely or incorrectly, and so on.

The effect of Void invoices is essentially to "undo" the invoice as if it had never been posted, restoring billed WIP to the WIP Open Item File. A credit memo is generated in PBS A/R to offset the original invoice.

If you are voiding the invoice for the purpose of making a correction to it and reissuing it, you may choose to have T/B automatically reselect (including adjustments) the WIP items that were billed on the invoice and also recreate the other billing transactions (such as retainer billings, fixed fee billings, etc.) that were billed on the invoice.

In order to use this selection, the invoice must still be on file in Invoice History. Additionally, if advance billings appeared on the invoice, then these billings on account must still be on account and not used in full or in part on other invoices.

Cash Receipts

If cash is not posted to A/R per T/B Control information, then it is simply memo information on the invoice and no special handling is required when using Void invoices.

If cash is posted to A/R during invoice posting, then the cash receipt will not be "undone" by Void invoices. This is because the cash receipt may have already been deposited in the bank, and thus cannot be undone.

If the invoice is not going to be rebilled, then the cash receipt in A/R can be made an open credit on account using Change apply-to # in A/R (if the client is an open item customer).

If the invoice is going to be rebilled, the following sequence should be followed in order to avoid a double posting of cash:

| 1. | Set Post cash to A/R ? to N in T/B Control information. |

| 2. | Void the invoice, specifying that you wish to bill the invoice again. |

| 3. | Make all needed corrections to the billing. Do not change the payment information on the billing transactions. |

| 4. | Post the invoice. This should be the only invoice posted at this time, as cash will be treated as a memo on all invoices posted. |

| 5. | Set Post cash to A/R ? to Y in the T/B Control information. |

| 6. | Set the apply-to number for the original cash receipt in A/R to be the invoice number of the new invoice, using Change apply-to # or due date (if the client is an open item customer). |

In order to "undo" the invoice as if it had never been posted, Void invoices must use and update many files within T/B. Thus, there are restrictions on when this function may be selected.

In a multi-user environment, only one user may enter "void invoice" transactions at a time.

The following selections cannot be run at the same time as Void invoices.

| • | Select WIP for billing |

| • | Retainer billing |

| • | Fixed fee billing |

| • | Contingent fee billing |

| • | Billing adjustments |

| • | Invoice history report |

Additionally, no WIP may be selected when Void invoices is run, nor can any other billing transactions (such as retainer billing transactions or fixed fee billing transactions) be on file.

Select

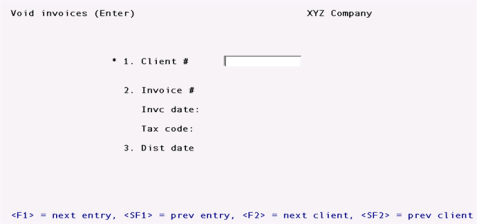

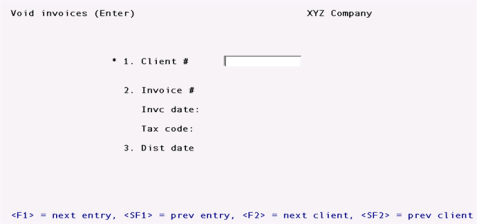

Enter from the Void invoices menu.

The following screen will be displayed:

1. Client #

Enter the client number for die invoice to be voided, or use one of the options:

|

<F1> |

For the next "void invoice" entry |

|

<SF1> |

For the previous "void invoice" entry |

|

<F2> |

To scan through the clients on file |

|

<SF2> |

To scan through previous clients on file |

|

Format |

12 characters |

2. Invoice #

Enter the number of the invoice to be voided, or use the option:

|

<F2> |

For the last invoice printed and posted for the client |

The invoice date and tax code for the invoice are displayed automatically.

|

Format |

999999 |

|

Note |

If the invoice being voided is not the last one posted for the client (or for a matter being billed), then the "Last invoice #" and "Last invoice date" fields will not be restored to their previous values in the Client record (or Matter record) when the "void invoice" transaction is posted. |

3. Dist date

The date displayed is the original invoice date.

If you are voiding the invoice in the same accounting period as it was posted, press ENTER to use this date.

If you are voiding the invoice in an accounting period which is later than the one in which it was originally posted, enter a distribution date within the current accounting period.

|

Format |

MMDDYY |

4. Bill again ?

This field is only displayed if 16. Post cash to A/R ? is set to N in Control information or if no payments were received with the invoice.

Answer N to void the invoice without restoring billing transactions and WIP selections. Answer Y to also restore all billing transactions and WIP selections.

Select

Edit list from the Void invoices menu.

You may also select Voided invoices edit list from the Reports, general menu.

Compare the edit list to the original Billing Registers to ensure that all WIP items and other billing transactions from the original invoices appear on the edit list.

Select

Post from the Void invoices menu.

During posting, a credit memo is placed in A/R Open Items to offset the original invoice. The document number for this credit memo is the invoice number prefixed with "CM". For example, if the original invoice was 000345, then the credit memo would be CM000345.

If you specified that an invoice was to be billed again, then after posting you may use the functions within the Billing selection to modify the WIP originally billed and to modify the other billing transactions such as retainer billing transactions, fixed fee transactions, and so on.